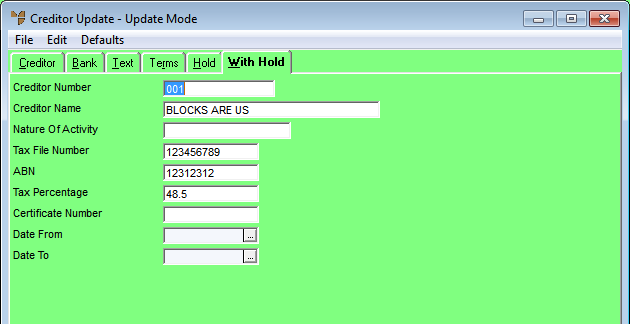

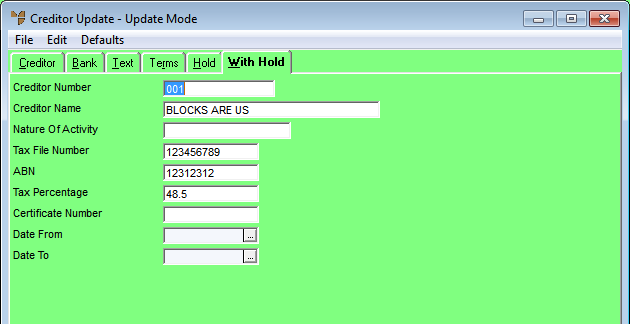

You use this tab to enter withholding tax or prescribed payments details for a creditor.

Refer to "Adding a New Creditor" or "Updating a Creditor".

Micronet displays the Creditor Update screen - With Hold tab.

|

|

Field |

Value |

|

|

Nature of Activity |

|

|

|

Tax File Number |

Enter the creditor's tax file number, if applicable. |

|

|

ABN |

Micronet displays the Australian Business Number entered on the Creditor Update screen - Creditor tab. If you don’t enter an ABN, when making payments Micronet prompts you to withdraw the tax percentage entered in the next field as a Tax Withholding amount. If you don’t know the creditor’s ABN, enter TBA to stop Micronet from withholding tax |

|

|

Tax Percentage |

Enter the tax percentage to withhold if no ABN is entered. |

|

|

Certificate Number |

If the creditor has a tax exemption certificate, enter the certificate number. |

|

|

Date From / To |

Enter the dates that the tax exemption certificate is valid, if applicable. |

For more information, refer to "Creditor Update Screen - Menu Options".